The Stock Market Sector Scuffle — Teaching Financial Literacy Through Argumentation

Overview

The Stock Market Sector Scuffle teaches math-based financial literacy using a real-world scenario in which students have to produce and analyze a financial data set in order to build arguments to convince “investors” that their sector-based stock portfolio holds the greatest promise of financial returns.

Financial literacy, especially in regards to financial investment and the stock market, is critical for young adults. It is an important knowledge-base that will play a role in just about every stage of an individual’s life. From managing an income in an effort to save money for college, to developing an early retirement investment plan; having a working knowledge of the stock market and its operations is imperative. More and more, commentators site a general lack of financial literacy as a contributor to risky financial behavior and lack of short and long-term savings goals that can negatively impact retirement plans.

Aside from developing and practicing a working knowledge of the stock market, the Stock Market Sector Scuffle helps students develop arguments based on the analysis of data generated daily by reporting done on the New York Stock Exchange. Through this process, they will gain an in-depth understanding of the ways that stock performance is analyzed. Additionally, students will be able to offer a critical comparative analysis of stocks and stock sectors. The Stock Market Sector Scuffle will offer students the ability to act as ‘financial advisors’ and require them to persuade the ‘client’ that they have the superior sector-based stock portfolio.

Initially, students will be divided into groups and assigned a sector and a stock portfolio on which to generate a data set. They then will analyze that data and build arguments for their sector-based portfolio against portfolios from other economic sectors.

Students are welcome to do additional research on their economic sector and their stock portfolio. One useful site to generate additional knowledge is Yahoo’s aggregating financial investment site. Also, Investopedia is a comprehensive finance-based website, including a finance dictionary and encyclopedia, articles, videos, and video tutorials.

The debatable issue for this project is:

Which of the five sector-based stock portfolios will produce the greatest return on investment (ROI)?

The five sectors of the U.S. economy that the portfolios in the Stock Market Sector Scuffle focus on are:

-

Finance

-

Transportation

-

Health Services

-

Energy

-

Technology

Method and Procedure

(1)

The students should be divided into 10 groups.

(2)

Each group should identify a group leader. The group leader should designate a member to fill each of these speaking roles:

(a) Opening Arguments (Case)

(b) Counter-Arguments

(c) Rebuttal Arguments

(d) Closing Arguments

(3)

Each group should be assigned a sector and sector-based portfolio to present and argue for during the project, as well as a sector to develop counter-arguments against. Each of the five sectors should have two groups assigned to it.

(4)

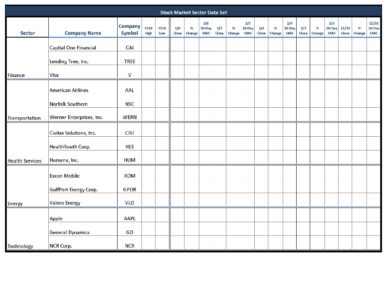

The groups should get the list of stocks that are emphasized in their sector-based portfolio. They should also get – electronically or in print – the three-sheet data set document that their portfolio document can be used to help them fill in. Each group should complete the data set for their sector. Groups assigned to the same sector can work together to complete the data set.

(5)

The teacher should collect these completed data forms, checking and assessing for accuracy, and should publish a single classroom-built data set that all groups can consult when building their arguments and counter-arguments.

(6)

The teacher should now introduce and orient students on the Stock Market Sector Scuffle format. In so doing, he or she should review model examples of the argument builder and counter-argument builder forms. Groups should clearly understand that the objective of the “scuffle” is to make arguments to convince a set of “investors” that their portfolio has the most appealing stocks in which to invest.

(7)

Groups should then be given time to build their arguments and counter-arguments (against the sector that they are assigned to argue against). Arguments and counter-arguments (each) must refer at least once (in claim, evidence, or reasoning) to each of the following terms:

Percentage change

Simple moving average

Trending up (or down)

Yearly high (or low)

(8)

Groups should be introduced to the Yahoo and Investopedia sites and told that they can do additional research to strengthen their arguments and counter-arguments.

(9)

Groups should submit their argument and counter-argument builders for formative assessment and feedback. And they should revise these instruments based on this feedback.

(10)

Now the Stock Market Sector Scuffle should begin. Five groups will participate first, one from each sector. The groups not arguing first serve as a pool of “investors,” who will select and rank the sectors that are arguing for their investment. When the first scuffle ends, the roles reverse and the group of investors become financial advisors and arguers, and the first groups become investors.

(11)

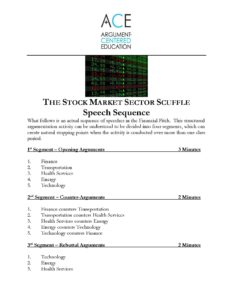

The scuffle’s four speech segments try to achieve specific objectives.

(a) The opening case from each sector lasts up to 3 minutes, consisting of two to three arguments, each with two pieces of evidence, arguing for their overall position (that their sector-based portfolio is most worthy of investment).

(b) After the opening cases, each group will deliver counter-arguments. These are two minutes of counter-arguments against the financial instrument that the group was assigned to counter.

(c) Next, each group will deliver a rebuttal in response to the counter-arguments. The objective of the rebuttal is to refute the counter-arguments made against the two arguments in the group’s opening analysis. This refutation can consist of new evidence or reasoning to support the initial argument, or analysis of the counter-argument’s evidence or reasoning.

(d) The final speech is a 3 minute closing statement that evaluates the arguments and counter-arguments and presents the final reasoning intended to persuade the investors that their sector-based portfolio is superior to the others.

(12)

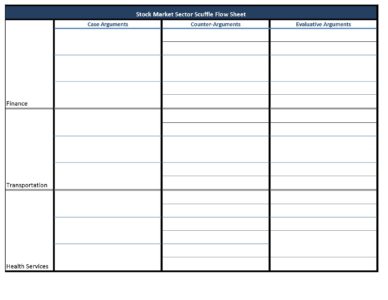

All of the arguments in the Stock Market Sector Scuffle should be tracked by the instructor on a projector, and every student in class should also track all of the arguments on their own flow sheet. The instructor can collect these flow sheets to keep all students accountable for staying fully engaged in the project.

(13)

After each scuffle, the half of the class that is not directly involved – that is, the groups that were assigned the other scenario – these students will role-play financial advisers to the customer in the scenario and each will select a sector-based portfolio to invest in, based on the arguments made.

(14)

Assessment should be based on instruments provided by Argument-Centered Education and should include individual and group grades.