Get Your Taxes Won . . . through Argument: Debating Tax Deduction Scenarios

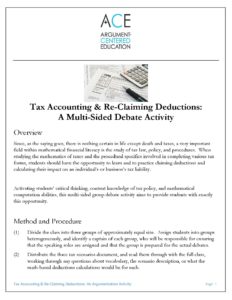

Overview

Since, as the saying goes, there is nothing certain in life except death and taxes, a very important field within mathematical financial literacy is the study of tax law, policy, and procedures. When studying the mathematics of taxes and the procedural specifics involved in completing various tax forms, students should have the opportunity to learn and to practice claiming deductions and calculating their impact on an individual’s or business’s tax liability.

Activating students’ critical thinking, content knowledge of tax policy, and mathematical computation abilities, this multi-sided group debate activity aims to provide students with exactly this opportunity. Students work through several scenarios in which possible clients of a tax preparation company have improperly filed deductions claims. Students then debate about which re-filing to re-claim deductions would be most lucrative for the clients (and the company).

As with other argument-based math projects, claims are based on mathematical computation as evidence, and an invocation of mathematical principles and rules forms the basis of the argumentative reasoning justifying the connection between the claim (often the solution) and the computational evidence.

Method and Procedure

(1)

Divide the class into three groups of approximately equal size. Assign students into groups heterogeneously, and identify a captain of each group, who will be responsible for ensuring that the speaking roles are assigned and that the group is prepared for the actual debates.

(2)

Distribute the three tax scenarios document, and read them through with the full class, working through any questions about vocabulary, the scenario description, or what the math-based deductions calculations would be for each.

(3)

Assign each group one of the scenarios. Each group will be arguing for the client in its scenario and against the other two clients in the other two scenarios.

(4)

Then announce to the class the following:

We are conducting a multi-sided group debate project on tax deduction policy, procedure, and computation. It has a role-playing aspect to it. Each group represents a small team of tax consultants, all working for the same H & R Block office. You are reviewing possible clients for your office to take, shortly before taxes are due (April 15th). You can’t take them all — even though you want everyone to get their taxes won! — so within each set of three possible clients, H & R Block has tasked you with recommending the top client. Clients are valuable in this particular pool based on how much money can be re-claimed if the client re-files their taxes and this time claims deductions that they were potential entitled to, but did not claim the first time. H & R Block receives 25% of all money that is re-claimed this way, so the more money that it can retrieve from the government through a re-filing, the more money the company makes! You need to work with your fellow tax consultants on your team to argue for which of the following clients your business should take on.

(5)

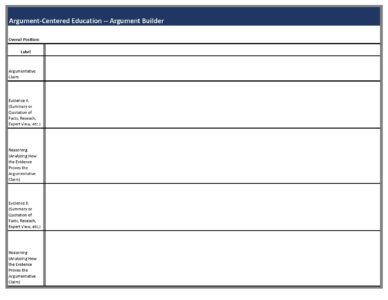

Distribute two argument builders and two counter-argument builders to each group. Tell students that they can get more from you if need be, but that they should build one or two arguments that support the position that their client should be prioritized by H & R Block, and one counter-argument against each of the other two clients. ArgumentBuilder1Arg16.05.17

(6)

Tell students that the next step is for them to follow the relevant tax laws and procedures in doing the computation necessary to determine how much each of the three clients would be able to retrieve from the IRS by claiming deductions that they did not claim initially.

(7)

They then should confer as a group about the best argument – claim, evidence, and reasoning – for the position that their client should be prioritized. If they are making two arguments, they need to be sure that each claim is formulated clearly discretely and distinctly from the other. You may want to spend some time at this stage leading a discussion with the class about what possible claims might be, and what their proper formulation might look like.

(8)

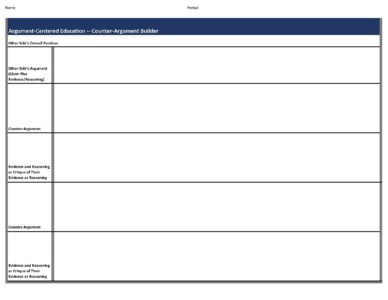

Groups should also work on one counter-argument against each of the other two clients. Here, too, formulation of the counter-claim is likely to be challenging, and therefore should be reviewed and discussed as a class.

(9)

Evidence for arguments and counter-arguments must include tax computation. Students can demonstrate their mathematical work on a board or in hand-outs that they pass around. Reasoning should invoke the relevant tax laws and policies that allow (or don’t allow) for certain deductions to be made.

(10)

When groups have been given enough time to formulate and build their arguments and counter-arguments, their captains should assign one student per speaking role for the four roles in the multi-sided group debate: case arguments, cross-examination, counter-arguments, and closing rebuttal.

(11)

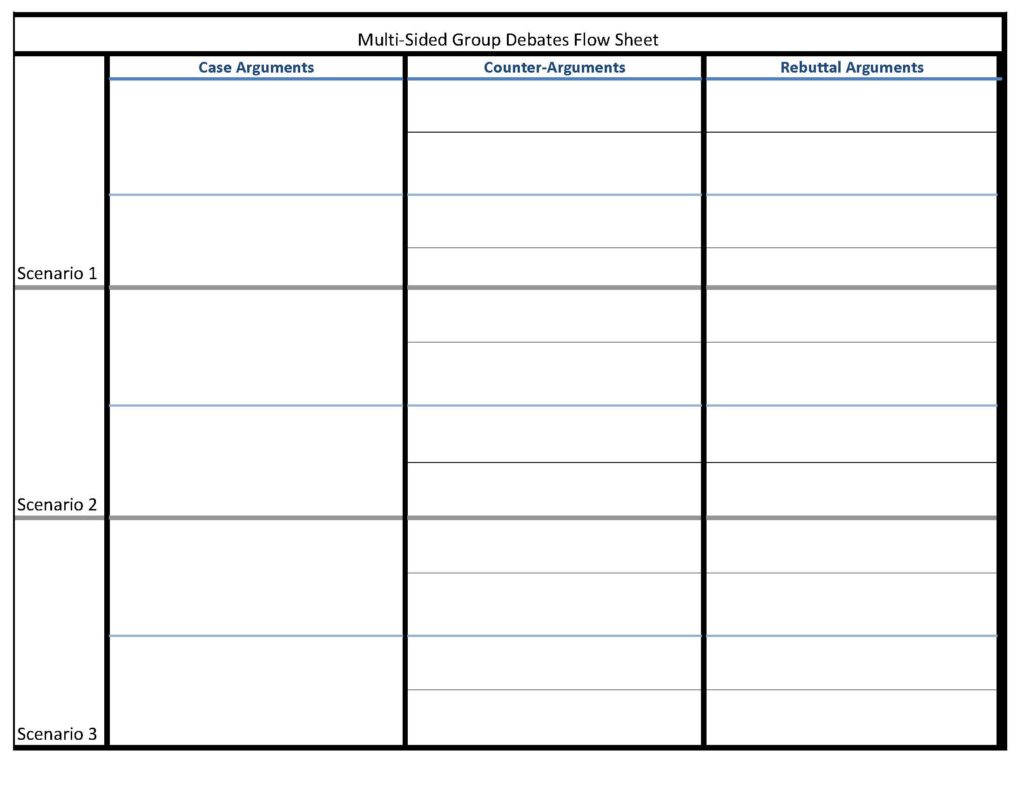

Each student should then get a flow sheet (i.e., an argumentation tracking form), so that everyone can flow the multi-sided group debate themselves. These flow sheets will be collected at the end of the period, along with each group’s argument and counter-argument builders.

(12)

The debate should begin. You should moderate the debate, keep time for each of the speeches, and flow (i.e., track) the argumentation on a flow sheet that you project on screen or smart board (or on a white board or chalk board).

(13)

This version of a multi-sided group debate format is as follows:

Case Arguments (3 minutes each – 9 minutes total)

Each consultant team makes its one or two arguments for its overall position – i.e., its overall argument that its client should be prioritized by H & R Block.

Cross-Examination (2 minutes each – 6 minutes total)

Each consultant team can ask questions of any of the other consultant team, in order to begin to cast doubt on their arguments and overall position.

Counter-Arguments (2 minutes each – 6 minutes total)

Each consultant team should make one counter-argument against each of the other two consultant teams’ arguments. The more specific these can be against the substance of the argument that the other team makes, the better the counter-argument.

Closing Rebuttals (3 minutes each – 9 minutes total)

The closing rebuttal should respond to the counter-arguments against the case, and should make a comparative, evidence-based evaluation of the positions in the debate, one that ultimately favors the client for which the consultant team is advocating.

(14)

Following the multi-sided group debate, you should ask for responses to the questions: Who had the best case argument? Cross-examination question? Cross-examination response? Counter-argument? Closing rebuttal? What made these examples so strong? What did we learn about tax law and deductions in this debate that either we didn’t know, or didn’t know as well?

(15)

Collect and formatively assess all argument builders, counter-argument builders, and flow sheets, using an ACE rubric and form.